Why does auction money functions? What type of property do you require it having? Who can have fun with market capital as well as how would you obtain it? Keep reading into the solutions to this and much more.

What exactly is public auction property financing?

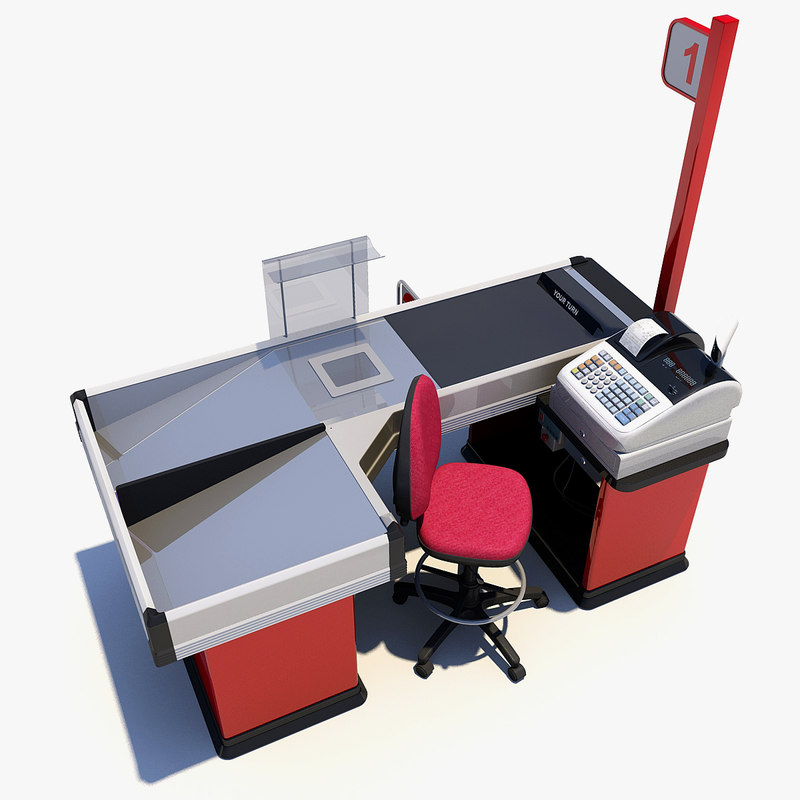

Auction finance is a kind of connecting or short-term finance which enables you to purchase residential, commercial and you will residential property at the a home market.

To shop for a house on market are a terrific way to get assets in the a reduced rates, and you can public auction financing makes you benefit from the opportunity.

Auction funds can be good way getting experienced and you will built designers to grow the newest portfolio. To buy possessions below the market value can definitely be the distinction so you’re able to ensuring a profitable roi.

To invest in property is straightforward and you may timely. Though it should be a leading-exposure approach, it will provide the possibility to get a house which have a fixed timescale known right away and have now allows the vendor discover a simple deals also.

Certain auction property will allow you to look at the assets prior to the new bidding procedure and this refers to the best chance to determine and value the house or property.

Even though the putting in a bid itself is blind, new market household do promote techniques rates ahead of time, so that you are able to prepare the cash. The brand new auction domestic will likely then servers the new public auction where you are able to bid. For individuals who winnings the fresh parcel, your usually need to pay ten% of effective bid quickly, providing constantly a month however in particular circumstance 6 months accomplish the fresh new payment.

- Usually view the property when possible.

- Shop around and know what the market industry property value the house is.

- Make sure to download a duplicate of the Court Pack’ on auctioneer’s web site. This can be a breakdown of the fresh new courtroom requirements toward client in advance of it find the family and may be considered just before pick.

- When the loans is required to find the possessions, revise the lending company of your own timescale you’ll need for the amount of money so you can be implemented.

- You need the brand new equity regarding even more assets to pay for right up to help you 100% of your price

Just how to fund market possessions

To invest in a property from the public auction is quite different to traditional purchasespletions happen much faster, which will is useful arrange your financing till the market gets into complete swing. Which is why of a lot buyers move to small-name auction finance choices to enable them to get rapidly.

Although price is not necessarily the merely reason traders choose bridging fund; here are the options that come with that it resource service:

- Investment to own non-fundamental and you can comprehensive design

- The money models felt

- Cost out-of 0.45% (other fees pertain).

A mortgage was a type of enough time-name fund and you can generally history five years. Protecting a mortgage requires a few months also it can perhaps not feel you can easily to have the money in the bank in a position for the latest short-time physical stature out-of a public auction purchase. The house may also need comprehensive remodeling, which a home loan does not typically create.

You don’t have to become an earnings consumer to purchase a beneficial property during the auction. You are able to expert market finance. A funds expert can help you support the capital you desire inside limited time physique, allowing you to build bid on a home rather than necessarily which have the money upfront.

The fresh get-off strategy

That have a feasible get off method is extremely important and you may built-in in order to protecting a connecting facility. The lender needs to be satisfied with their agreements to own settling the loan while the title has ended.

In case your exit method is to offer the home, then the financial could be trying to find proof of a better value and you will a marketable property.

Having fun with an auction funds representative

The help of the right auction financing broker is the difference in acceptance and you may rejection otherwise landing plenty and you may getting encumbered having disadvantageous rates.

Our team possess years of real information coping with change companies, property investors, builders and you can landlords and can assist position the manage the latest most appropriate lenders.

We offer 100 % free pro recommendations, so if you was new to getting during the auction and possess zero exposure to the connecting market, we can let.

Discover more about our very own Market Funds product

- Prosper

We’re a good British fund agent seriously interested in finding the right fund alternatives to possess SMEs and you may possessions backed businesses along best Maine banks with personal loans the British along with all of the sector.

Accessing just the right financing if it’s necessary are a critical the main gains excursion of one’s team. Newable Fund can give you the independent angle, entire out-of industry reach while the breadth of experience to safe the timely and flexible money expected to send your own increases goals.

The mortgage Possessions (That is certainly Your house) Is generally REPOSSESSED If you do not Keep up Costs Towards Your Financial.