Basically, you won’t want to remove people the latest obligations when you are undergoing closure an interest rate. Thus, whenever Are you willing to Rating a personal bank loan Just after To buy a home?

Together with, once you’ve signed for the that loan, you truly need certainly to hold off 3 to 6 days before you take out an unsecured loan.

Unsecured loans can be handy to own residents, and there is zero certified code which you can not get one if you find yourself interested in property.

- Your credit score can take a hit and you may affect your loan cost

- Your debt-to-money proportion could possibly get raise and connect with your own financial qualification

- Whenever you are already working with a lending company, they are informed with the financing activity

- You may also impact the real estate loan qualification even though you been eliminated to shut

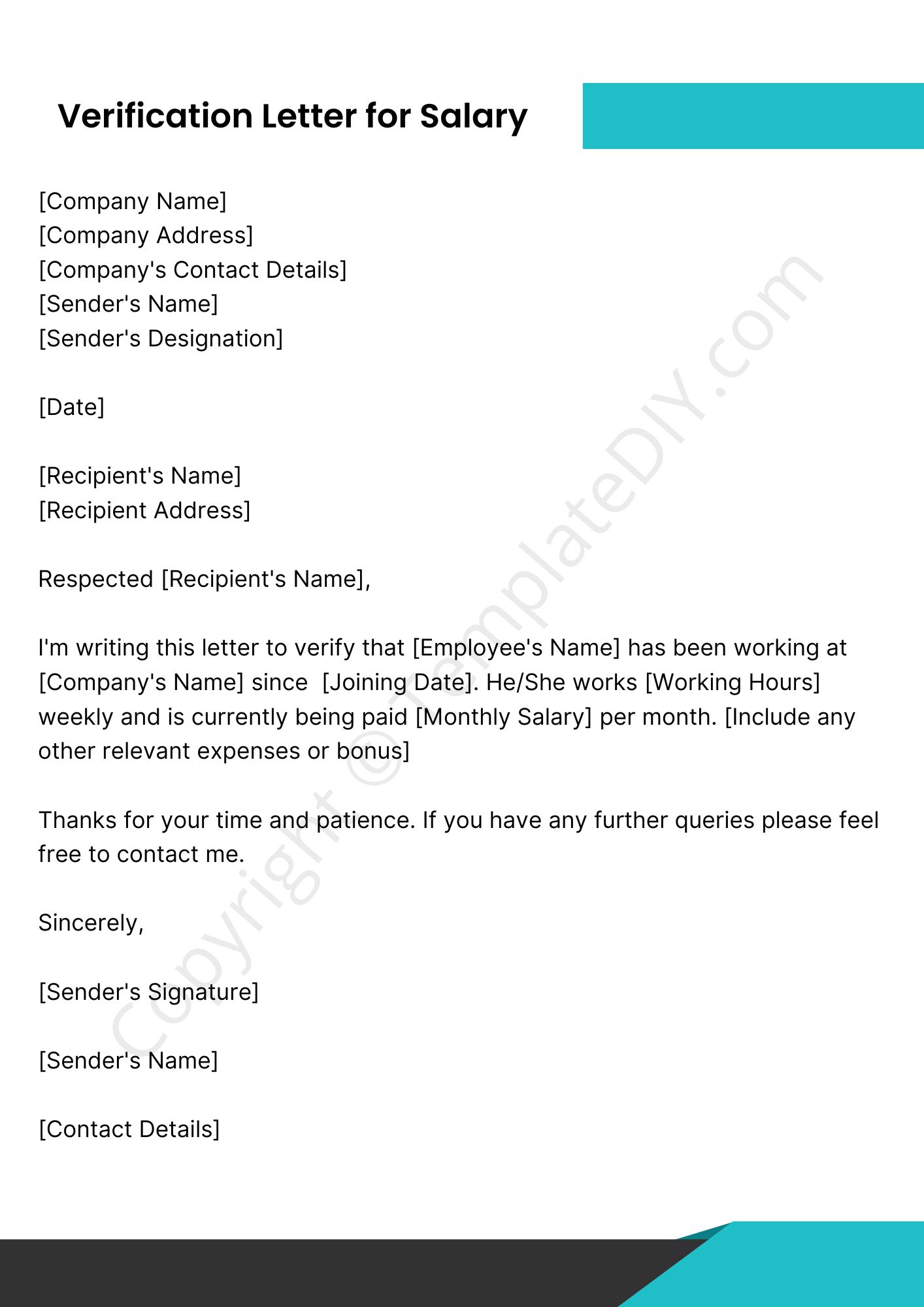

If you’re nevertheless not knowing off if or not you personal installment loans in Cleveland really need to take-out a good personal bank loan when selecting property, we have found a keen infographic that may help you discover:

When you get a consumer loan When purchasing a property? Do’s and you can Don’ts

- Try and take out a personal bank loan to fund the newest downpayment.

- Propose to acquire to cover closing costs, monitors, moving will cost you, etc. having a personal bank loan.

- Pull out that loan anyway if you are planning to utilize to own home financing in the near future, typically.

- Make an effort to mask consumer loan passion off loan providers.

- Use a consumer loan to own expenditures such as for instance chairs, fixes, home improvements, and you can low-mortgage expenses better after you’ve currently compensated on your new house.

Costs related to the newest product sales-particularly appraisals, monitors, and you can off payments-should be paid for with cash otherwise away from money lent privately on the mortgage lender.

Note that so it pertains to more than simply unsecured loans. Even borrowing off family and friends will often has actually unforeseen outcomes. Given that have a tendency to, home loan pros feedback your financial pastime observe how much time you got your finances. Any sudden highest expands may need to end up being explained to the new possible mortgagor, that may damage your chances to help you be eligible for a mortgage.

Let! I purchased a home now I am Domestic Worst

Whether your mortgage payments is trying out way more compared to the advised 25% of the grab-domestic shell out, it’s also possible to getting financially limited, aka home poor.

This might be a tricky situation to deal with. Here are some info if you are up against a casing-associated economic crisis:

While in Question, Pose a question to your Financial Officer

Unsecured loans may come when you look at the available to residents seeking developments or fixes. Nonetheless is going to be challenging to use close to home-purchasing go out.

In any case, you can inquire the newest broker you’re coping with if the delivering aside a personal loan can be helpful. For every single mortgagor differs and more than need to make it easier to has a successful homebuying sense, so it is essentially great for believe in its recommendations.

All the information contained in this blog post is actually for general informational intentions just. Republic Financing cannot make guarantees otherwise representations of any form, show or required, according to pointers offered contained in this post, like the reliability, completeness, physical fitness, usefulness, availability, adequacy, or precision of your own guidance contained in this post. All the information contained herein is not supposed to be and you can does perhaps not comprise financial, courtroom, taxation or any other suggestions. Republic Money doesn’t have responsibility the errors, omissions, or inaccuracies on the recommendations or one responsibility as a result of one reliance put-on for example guidance from you or anyone who will get be informed of one’s pointers in this article. People dependency you put towards the guidance within this article is precisely at the very own chance. Republic Fund get resource businesses in this post. A third-team source does not form support, association, connection, or approval of that third party. Any third-group trademarks referenced are the property of its particular people. Your own use and you can accessibility this web site, webpages, and people Republic Loans webpages or mobile software is at the mercy of our Terms of use, available right here.