- Tick icon to have list of guidelines product reputation step one

What is actually a citizen Financing?

A citizen loan now offers ways to borrow a large amount away from currency, generally anywhere between ?3,000 and you may ?100,000. It is simply accessible to consumers just who often own their property downright, otherwise have a home loan that have an amount out-of collateral. Costs are usually made-over a time period of four to help you 20 years plus the interest can differ. The primary is that your particular house is used to be sure repayments. Thus for people who miss money, your house could well be repossessed and sold to repay the debt.

Why should We Be mindful?

Citizen money are generally seen as a past resorts, because if you earn to the financial challenge you can treat your home. They want to never be taken out to fund too many costs eg as the a holiday. Repayments are spread-over several years of time very monthly premiums will be lower, but the complete number of focus reduced could be extremely high. Rather than signature loans, your interest rate is not constantly fixed, definition the lender can increase your own %Apr when they such as for example.

If you have a poor credit record: Citizen fund are better to availability than just unsecured loans, which make all of them a good idea of these that have less than perfect credit histories. This is because the lending company are providing less exposure, simply because they can be recover their funds of the repossessing your residence in the event the you neglect to pay up.

If you would like combine present expenses: It indicates settling your old bills with financing at the an excellent straight down rate of interest, and this minimizes month-to-month payments plus the level of notice paid off full.

But not, be aware that of numerous loans have penalties for folks who pay all of them very early. Get in touch with a free of charge loans foundation instance Action Change or National Debtline for guidance just before consolidating personal debt.

Do i need to Pay for It?

Constantly borrow as little as you’ll, towards smallest big date you can. This can be sure you pay the minimum quantity of notice. Remember the prolonged your pass on your debt, more interest might spend.

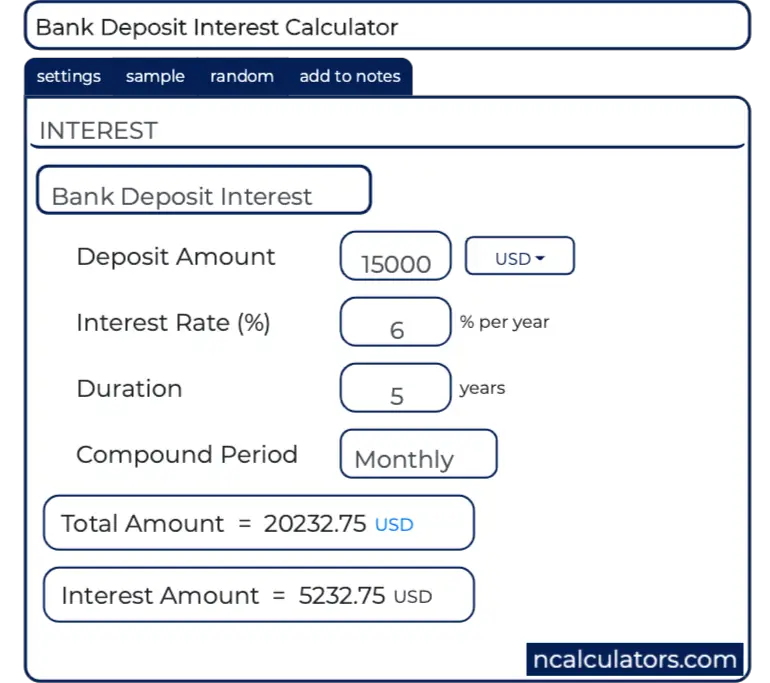

Think hard about how precisely far you might manage to shell out for each week. Such, for folks who borrow ?100,000 over 20 years during the 5.7% notice, you’ll repay ? four weeks. This makes the full focus ?66,373 of course the interest rate remains an identical that it might not.

https://elitecashadvance.com/installment-loans-ar/

TotallyMoney’s customised borrowing analysis product makes you contrast various other loan quantity, and more installment attacks, to reveal the difference within the monthly obligations. This can help you to choose just how much you really can afford so you’re able to obtain, as well as over just what time.

Select how your needs and you will funds get transform during the 10 otherwise 20 years’ date do you remain in a position to pay the money? Never ever, actually ever obtain more than your want.

Exactly what Interest rate Can i Shell out?

The pace you are provided towards a loan all depends on your credit rating. May possibly not always end up being the interest advertised by the financial otherwise strengthening community. Just 51% away from successful candidates are given the fresh new member %Apr. Others was offered a top interest, and others simply getting denied. Unfortunately, your usually have no idea just what rate of interest you’re offered unless you sign up for the mortgage.

Applying for numerous money can harm your credit score, while the banking companies don’t like observe which you have come denied several times. Fortunately one to TotallyMoney’s personalised borrowing comparison unit service will tell you when you are probably be acknowledged having good resident loan Before you apply.

All of our complex qualifications checking technical works a silky research you to will not hop out a mark-on their credit file. I then compare several loan providers supply you an over-all possibilities. This means need simply apply for secured homeowner finance one you are aware you likely will get.

Do We have Adequate Security?

You might normally only obtain as often collateral as you have of your house. Security refers to the ratio of your house that you individual outright, instead home financing. Including, in case your home is well worth ?150,000 along with your a good home loan was ?50,000, then you’ve ?100,000 out-of collateral.

Pros and cons

Secured finance: Think hard In advance of Securing Almost every other Expenses Against Your property. Your home May be REPOSSESSED If you don’t Keep pace Money Towards the A home loan Or any other Obligations Covered Inside it.

If you remove a homeowner loan, you concur that your information was taken to good borrowing from the bank agent who’ll get in touch with you of the cellphone and you may/otherwise email address to learn more about your criteria. This permits the new agent to ensure you are put so you can financing items that fulfill your personal standards and you can financial situations.

When you do and come up with an application, the fresh broker have a tendency to help you of every arrangement percentage you’ll be able to getting charged when taking away a loan.