When the a home loan company mentions conditions such as credit otherwise activities, please ask for explanation. You should make sure the facts and be in a position and work out an audio decision one set your up to achieve your goals in the long term.

But not, the financial will make computations suitable to your state and offer a loan Guess in this around three business days of you completing an excellent application for the loan

Dismiss activities allow you to spend far more initial to receive a lower interest. You to definitely straight down interest you may lower your monthly homeloan payment otherwise beat how many costs you will want to make in advance of your home is paid off. Or even plan on refinancing or expenses your own home loan off early, to acquire facts could well be recommended.

When you are in search of to get items, understand that one point is equivalent to 1 percent of your own amount borrowed. It is not one percent of the interest rate, in the event its sometimes puzzled.

If they sign up for a great $100,000 mortgage, some point create portray 1% of these count, or $step 1,000. Capable also buy partial circumstances, so a half-area might be $five-hundred, and something-and-a-one-fourth points could be $1,250.

If they choose to buy situations, the fresh new buck count might be owed from the closure, that raise its complete closing costs. Although not, the brand new bad credit loans in Garden City facts ordered often decrease the rate of interest on the financing, for example they’ve got straight down monthly installments. How much cash the pace is actually reduced utilizes the lending company.

Before making a decision, they will certainly must query the lender to have basic facts exactly how to get factors usually feeling their interest price and you can monthly obligations. The greater number of factors they purchase, the lower their rate could be.

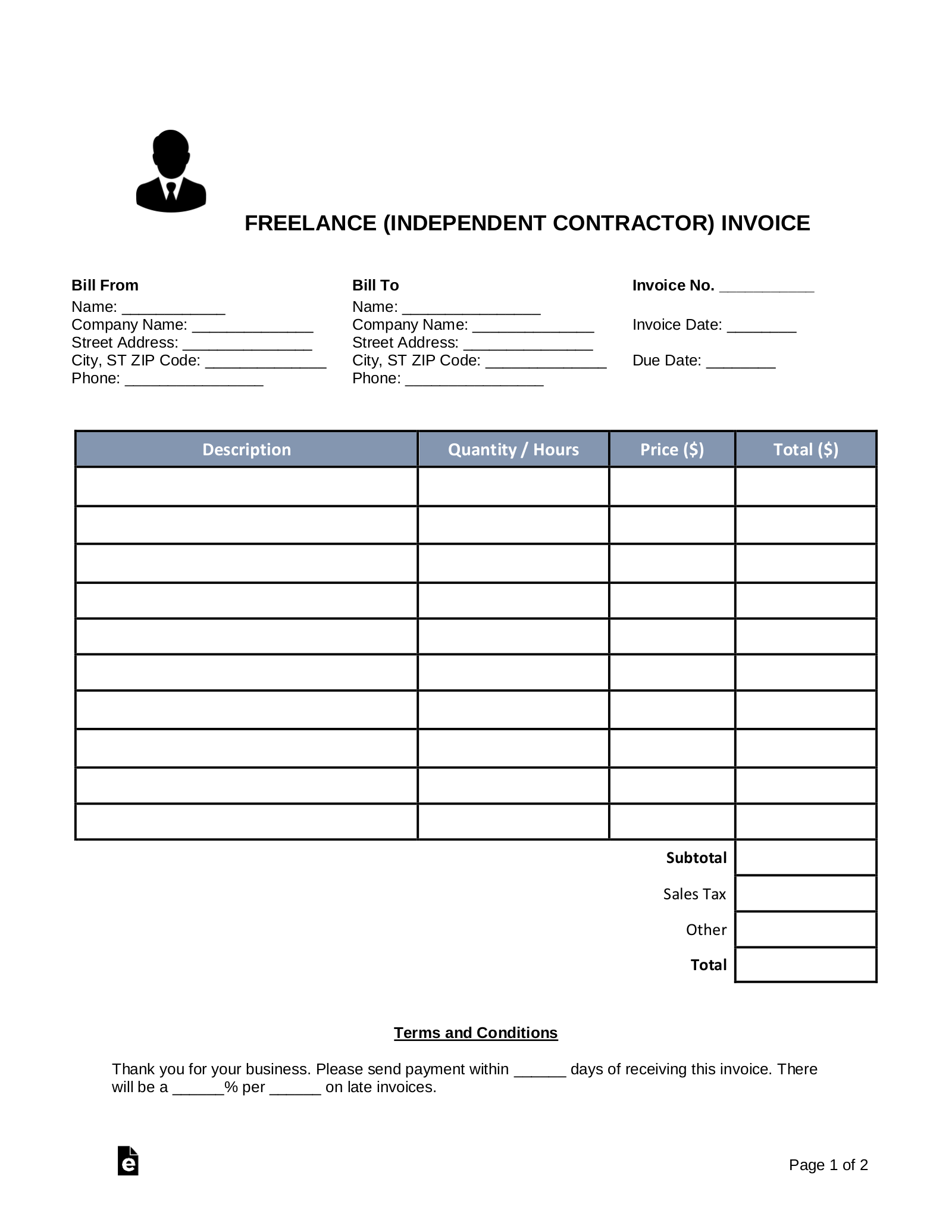

The loan Estimate directories information for instance the type of mortgage, the borrowed funds matter, dismiss facts, insurance rates, projected month-to-month mortgage repayments, and you can estimated closing costs. It is best to carefully opinion the loan Estimate to guarantee it fits the expectations.

Remember that a loan Guess is not an acceptance otherwise denial of your application, and it doesn’t mean you simply can’t replace the facts. It’s meant just while the facts about the mortgage bundle your chatted about together with your . You can use it evaluate almost every other even offers side of the side.

If the approved, and you also deal with, the information according to dismiss points you have bought will be placed in a closing Disclosure, and this their bank will provide about around three working days before closure. That it document provides the signed facts and you will terms of the loan and financial charges, your own monthly payments, as well as costs due in the closing.

The specific number you’ll save each point relies on the type of financing, the present day sector, their financial, or other items.

But not completely appropriate, it’s beneficial to remember a loan provider credit once the contrary regarding circumstances. When you purchase dismiss products, your settlement costs increase. But not, for folks who accept bank borrowing from the bank, the settlement costs go down. In addition, of the agreeing to invest items at the closure you can aquire a beneficial down rate of interest along side life of the loan, so your monthly installments might be all the way down along the term of your loan.

The loan amount may possibly not be as simple to work with because the an amount $100,000

The latest unmarried mother said before, just who plans to get a small house in the city where their particular a few mature people live, may want to understand what lender is? This may be advisable having their particular, as she already enjoys limited dollars, but zero concerns about future earnings or expenditures. In addition, she has unclear plans and may also plan to proceed to an excellent much warmer weather in four or 10 years.