We have seen several different successful eBay QuickBooks integration methods. It all depends on the tools you prefer and the functionalities you want. With the help of listing optimization, your offerings can stand out in a sea of products. With a single click you can quickly see your profit & loss, balance sheet, and dozens of other reports.

Intuit QuickBooks and Amazon Business

Reporting capabilities increase with each plan, but even the least expensive Simple Start plan includes more than 50 reports. You can also use optional payroll features to pay employees with direct deposit. The software even handles all applicable https://www.business-accounting.net/ taxes to cover you and your employees when tax season rolls around. The initial setup process involves creating your company profile, connecting bank accounts, and configuring your preferences according to your business needs.

Simplify selling on Amazon with QuickBooks Commerce

That’s why QuickBooks’s ability to account for the current exchange rate is very helpful. It will determine the correct currency amount at the sale or purchase, giving you and your accounting staff accurate numbers and peace of mind. QuickBooks is an exceptional accounting system for viewing your bookkeeping numbers.

- QuickBooks is an exceptional accounting system for viewing your bookkeeping numbers.

- You can generate comprehensive reports that provide insights into your business’s performance, profitability, and cash flow.

- And because it’s a cloud-based system, you’ll be able to access your real-time accounting and other business data on the go from anywhere.

- They’ll need a robust forecast of their potential income and expenses to plan well.

- New users can choose between a 30-day free trial or a three-month 50% discount.

Work With Your Bookkeeper to Manage Your COGS and Inventory Properly

Bookkeeping and accounting agencies understand this predicament. That’s why we handle the accounting aspects of your inventory to ensure you get the right COGS. This is crucial, especially when determining the correct net profit in your business’s income statement. EcomBalance is a monthly bookkeeping service what is a cost variance for eCommerce companies. EcomBalance handles your bookkeeping and sends you a Profit and Loss Statement, Balance Sheet, and Cash Flow Statement by the 15th of each month. EcomBalance also has a sister company, AccountsBalance, that caters to agencies, software companies, coaches, and other online companies.

If you connect an app with a high volume of daily transactions, QuickBooks Online may freeze. To fix or prevent this from happening, you must change the sync options in the app to allow it to bring over a daily summary instead of individual transactions. Like most federal holidays, expect your local banks and credit unions to be closed in observance of Juneteenth.

If you can’t keep up, you might find yourself facing a sticky late tax payment situation down the road. Sync data from popular apps like QuickBooks Time, Shopify, PayPal, and many others. Set up recurring payments for automatic bill pay that’s hassle-free. The nation’s newest federal holiday — Juneteenth — lands in the middle of the workweek next week.

Plan ahead if you think you will need anything from your bank on June 19. Limited third-party integrations available; no POS or payroll integrations. Entry-level plan limits bills and invoices to five and 20 per month, respectively. Expert advice and resources for today’s accounting professionals.

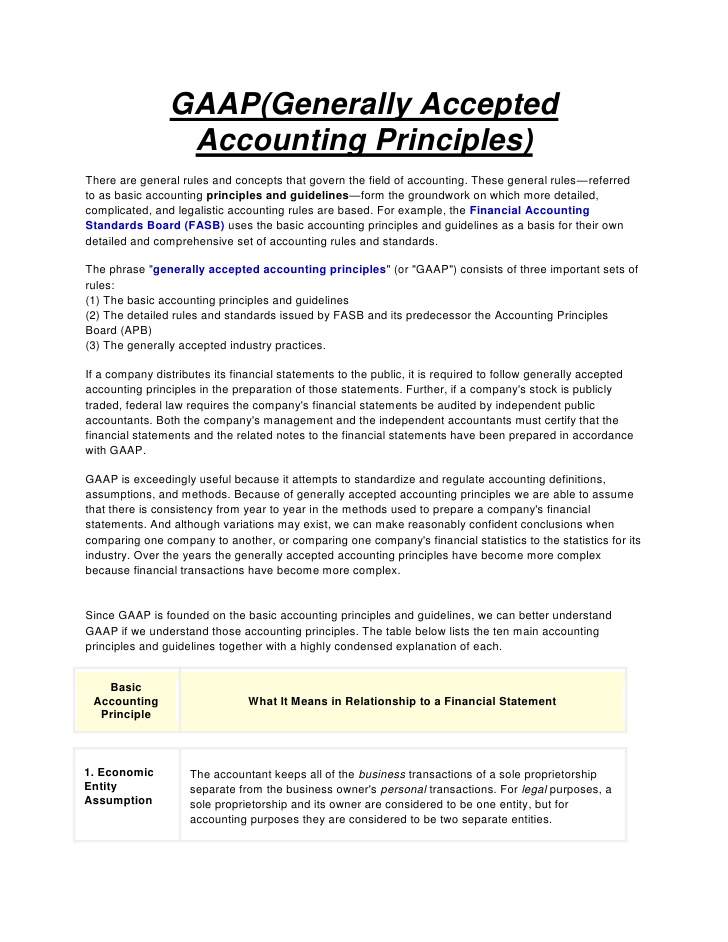

Accounting software is like a database for all of your business’s financial transactions. It helps you follow basic accounting principles so that you can keep your books up to date and in order, which is especially important come tax season. Most software uses double-entry accounting, meaning it factors in assets, liabilities and equity, in addition to revenue and expenses. ● Third-Party App Integration — Lastly, QuickBooks makes it easy to add plugins and third-party apps that can greatly enhance functionality and tailor the experience to fit your needs.

QuickBooks intuitively guides you through each step, ensuring a smooth setup process. Developed for inventory management in warehouses, SKUs refer to unique alpha-numeric codes assigned to each of your products and their variants. A SKU can consist of any combination of letters and numbers that you choose, just as long as the system is consistent and used for all the products in your inventory.

As an industry-leading accounting software with a suite of commerce-focused products, QuickBooks enables sellers to automate eCommerce accounts and access daily financial reports. Like QuickBooks Online, FreshBooks excels at offering professional, customizable invoices that are easy to draw up both online and via the mobile accounting app. https://www.accountingcoaching.online/allowance-for-doubtful-accounts-meaning-accounting/ Its well-organized dashboard includes a client portal business owners can use to collaborate with their customers on generating quotes, approving estimates, creating invoices and accepting payments. In stark contrast to QuickBooks Online, each Xero accounting plan includes basic inventory management and an unlimited number of users.

Additionally, because the data is stored on offsite Intuit servers, you can access your data from anywhere. If you want to know which products are selling well and which to discontinue, QuickBooks provides comprehensive data that makes smart reordering a breeze. QuickBooks Online also tracks all lost, damaged, or defective products, so you can keep track of your inventory right down to the item. You want to spend your time running your business, not stressing out over your finances or tax returns, right?

QuickBooks automates the process entirely so you can focus on other details. Every time you make a sale or issue a refund, that transaction is recorded automatically, and the totals adjust. Not only does this accounting method save you a substantial amount of time and effort, but it’s unparalleled in its accuracy. I created a posting worksheet that I use for each payment statement.